Association of Chartered Certified Accountants By ACCA – UK

The Association of Chartered Certified Accountants (ACCA) is the global professional body offering the Chartered Certified Accountant qualification. Whether you’re looking to pursue a career in accountancy, or finance, or take on a management role, ACCA provides ambitious professionals with the most relevant accounting competencies as well as in-demand skills required in modern business practice. As a graduate, you can explore a range of career options in either general practice or a more specialized area, such as auditing, tax, corporate finance, business recovery, forensic accounting, and more.

$300.00$500.00

Career After ACCA Certification

ACCA is the world’s leading Professional Accounting Qualification. The ACCA qualification helps to develop successful careers in the fields of Accounting.

219,000 + Members, 179 + Countries, 527,000 + Students

Why ACCA

When you study with ACCA, you can take your career in any direction. You open doors to the best and most interesting roles all over the world. And you become one of the sought-after finance professionals our fast-changing world needs.

Course Details

Topic 1: Risks and methods of money laundering and terrorism financing (26%)

Topic 2: Compliance standards for anti-money laundering and combating the financing of terrorism (CFT) (25%)

Topic 3: Anti-money laundering (AML), CFT and sanctions compliance programs (28%).

Topic 4: Conducting or supporting investigations process (21%)

CAMS Course Benefits:

Drive a culture of compliance from the top-down.

Demonstrate your commitment to a standardized risk-based approach.

Reward and retain top talent.

More effectively safeguard against financial and reputational damage.

Why you should become an ACCA?

- You are looking at a global career

- You want to deepen your knowledge in accounting

- You want to improve your resume and role

- Looking to earn more

ACAMS FAQs

Who are the Trainers?

Our trainers are Qualified CA, ACCA, CPA(USA) having more than 15+ Industry Experiences as well as having experience of teaching for more than 10 years.

Can a student take the ACCA qualification in any order?

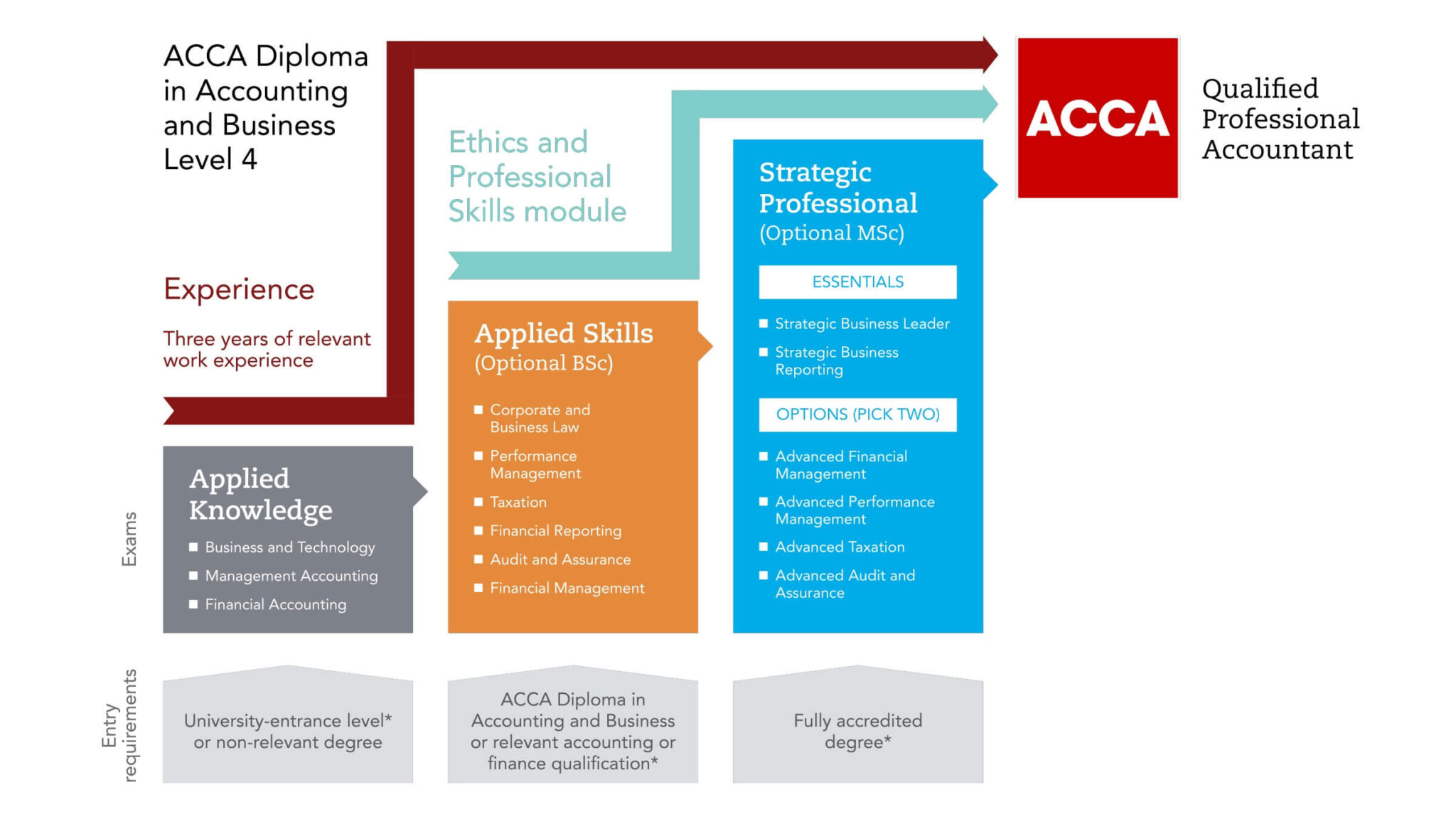

You can take up to a maximum of four papers per examination cycle. There are 4 examination cycles per year which are March, June, September and December. Papers/examinations must be taken in following order of modules (Knowledge/Skills/Professional) order. Within each module, you can attempt papers in any order. However, ACCA recommends that papers within a module should be attempted in that order as the syllabus has been developed to teach the subjects in a definite order.

What ACCA course material will be provided?

You will be provided with the following:

- AFTI Study Materials

- Lectures from 30 to 40 Hours for each part

- Study Plan

- In house Mock Exam

- Revision Session

- Success Notes & Guidance before Examination

How does a candidate find out the venue and schedule on exam day?

You need to log on to your myacca account approximately two weeks after standard exam entry closes to download and print your exam attendance docket. This will include the address of the centre, the papers you have been entered for, the dates for each paper and the desk numbers that are allocated to you in a particular venue. You must not forget to take your exam attendance docket with you to the examination centre. Always carry a valid photo identity proof as applicable.

Can all students who have qualified 10+2 join ACCA?

The students who have scored 65% in English & Maths and 50% in the remaining subjects in 10+2 are eligible for ACCA qualification. Other students are eligible to join ACCA through Foundation in Accountancy (FIA) Route, which is an entry level qualification towards ACCA. 12th pass students who have scored below 65% need to give only 3 exams in Foundation level FMA, FAB, FF

Delivery & Assessment

Format: Online interactive sessions, corporate workshops, self-paced modules.

Assessment: Case studies, financial analysis exercises, and capstone submission.

Navigate

AFTI Courses

Address

Abu Dhabi.UAE.

Sharjah, UAE.

Canary Wharf, London,

England E14 5RE, UK

© 2025 Academy for Finance, Technology and Innovation. All Right Reserved.

Reviews

There are no reviews yet.