Tulip Mania Moment for Cryptocurrencies…

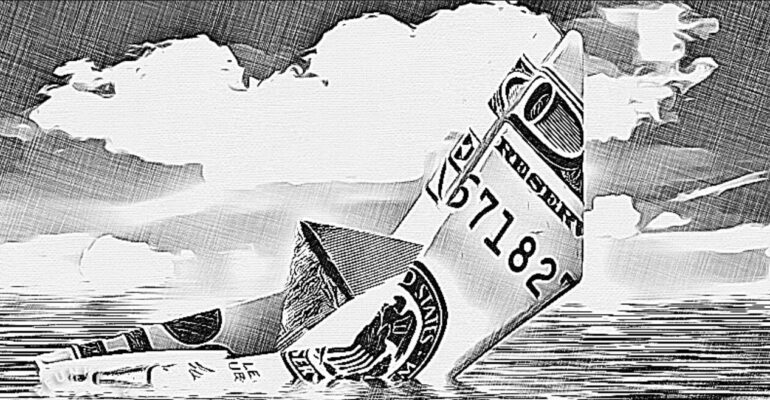

In 1594 a tulip flower was introduced in Holland. The Tulip as it was sold in Europe and as the demand for this flower increased prices of 1 bulb of Tulip reached to unbelievable level equal to prices of house in Holland. Many started trading with their own money or borrowed money as it gave them quick profit in 1634. This noise trading peak in 1637 where farmers, traders, speculator started pushing prices even higher only to realise this perishable flower prices are crash. Many lost their life savings as the hype spread across Europe where individual started buying and selling in future crop harvest. This lesson is taught in every economics class as Tulip Mania. Hence my a belief increased in the popular quote; “History repeats itself”.

This article is an attempt to answer questions raised in my previous article;”Tell your friend only as much as your enemy needs to know-FTX Saga”. On 8th November 2022 FTX faced a liquidity crisis and Binance the initial investor (a competitor) came to rescue with condition of due diligence. As a professor of finance and strategy I believe this was a master stroke to buy second largest exchange at throw away price(FTT the FTX token was trading as low as $2.5 from high’s of $25). However, yesterday the founder of Binance announced they won’t go ahead with the deal as there are governance, compliance and regulatory concerns. All hell broke lose in the cryptocurrency market which was on a ventilator, evident from Bitcoin rising by $1600 on 10th November’22 after ruthless fall for days. It has reversed all its gain today as I write this article on 11th November’22. There are some fundamental questions that needs to be answered from the FTX Saga.

Is this the end of cryptocurrency market ?

Answer is both Yes and No.

- Let me explain, Yes for those who are treating cryptocurrency as an alternative asset class. The fundamentally any currency without collateral would be valued purely on demand and supply. Since cryptocurrencies like Luna or FTT are created on proprietary platform supply cannot be controlled greed will always set in as stake increases. Hence as an asset class it purely a bubble created by noise trading.

- No cryptocurrency will for those who are treating cryptocurrency as a currency to send and receive payments. There are many Central banks which failed to stem fall in their currency against US dollar where adoption of cryptocurrency payments is widely accepted. There is tremendous opportunity in blockchain enabled peer to peer payment system. I am confident this will be the biggest disruption most Central Banks will have to deal with as this will threaten existence of Fiat currency.

How can FTT exchange post revenue of $1billion and then face liquidity crisis ? Where did the money that came in from Retail investors go ? Was the exchange run as a Ponzi scheme ? The entire concept of decentralised platform is to bring credibility through multiple instance of record to solve problem of double spending. Simple regulatory intervention should be able to address future frauds;

- Quarterly Audit of Financial Reports both inflow of money and outflow of money.

- Quarterly Proof of 1:1 cash Audited Reports.

- Liquidity Management Framework.

Human intelligence works more efficiently to break rule rather than following it; hence this list should be updated going forward. Quadriga CX was the first exchange to shatter crypto-dream run and now FTT. Finally, I would like to conclude with a quote for the Crypto-Investors;” People with money are left with Experience and People with Experience are left with Money…”